Read Time6 Mins

Oscar Wilde once said, “When I was young, I thought that money was the most important thing in life; now that I am old, I know that it is.”

Since Wilde’s time, the importance of money has increased significantly. But the importance of wealth management has increased several times more than that. What’s critical is regardless of whether families have enough to just meet their financial needs or have built generational wealth; protecting, growing, and sustaining it requires professional assistance. And this is where a family office software comes into the picture.

What is a family office?

Before delving deep into what Family Office Software is, let’s look at a common misconception about family offices. Most people think that family offices are only for the super-rich. That’s wrong. Whether a family owns real estate property, or has a million-dollar art collection, or some cash earning interest in a bank account, it needs the assistance of a family office.

Why?

Because a family office setup allows tracking and consolidating income-generating assets, reconciling accounts, identifying new investment avenues, managing risk, safeguarding crucial documents, monitoring philanthropic initiatives, and ensuring smooth transition of wealth to the next generation.

Also Read: The Benefits of Consolidating Your Investment Data

How have family offices evolved over time?

John D. Rockefeller Sr., the legendary billionaire, is widely considered the founder of the modern family office. However, similar setups existed for many centuries with their unique governance rules and hierarchical structures. Irrespective of when family offices first emerged, the following three reasons have encouraged wealthy families since time immemorial to stick to a family office type of structure to manage their wealth:

- The desire to keep the family’s wealth confidential

- To operate in a less stringent regulatory environment

- To sustain the family’s wealth and ensure it passes on to the next generation in a seamless way

What started as a way for ultra-wealthy families to protect, grow, and pass on their wealth was gradually adopted by families across the economic spectrum. Therefore, a specialized cadre of expert financial advisors emerged to simplify the complexities involved in managing wealth by establishing family offices. With time, many of these family offices merged to achieve economies of scale and provide services to multiple families over different jurisdictions. This is how multi-family offices were born.

5 reasons why you need a family office software?

Without a family office run by professional advisors and specialized software, managing wealth can take a “U-turn” at any time. Here are six reasons why you must consider setting up a family office for efficiently managing your hard-earned money.

1.The wealth accumulator vs. wealth manager mindset

Most wealthy individuals do not exercise the same level of discipline and rigor in managing wealth as they did while accumulating it. But a family office creates a clear line of distinction between income-generating business activities (the wealth accumulator mindset) and strategies that allow their judicious management (the wealth manager mindset). Family office software, equipped with numerous wealth tracking capabilities facilitates ground-level implementation of this approach by providing actionable investment insights for better wealth management.

2.Complexity in managing assets

While globalization has enabled families to own assets across the world, it also calls for a deep understanding of tax laws and regulatory compliance that apply in different jurisdictions. This understanding is crucial as it helps determine the most efficient tax harvesting strategies and protects against penalties for non-compliance with jurisdiction-specific regulations. Thankfully, family office software offers specialized accounting capabilities such as auto updating the ledger for transactions related to investments, income, and expense. They further simplify tax planning by generating reports for calculating capital gains and helping to align with global IFRS and GAAP standards.

3.Data foundation for succession planning

The “great wealth transfer”, which refers to the transfer of wealth from the boomers to the millennials, is estimated to be around $84.4 trillion through 2045. Despite such a substantial figure, over 41% of families lack a succession plan for their family members. Also, according to this report, 60% of families who reported that preparing the next line of leaders for responsible ownership was a key concern, only 20% had an educational program in place to address this need.

Also Read: Advanced Tax Planning Strategies for UHNW Clients

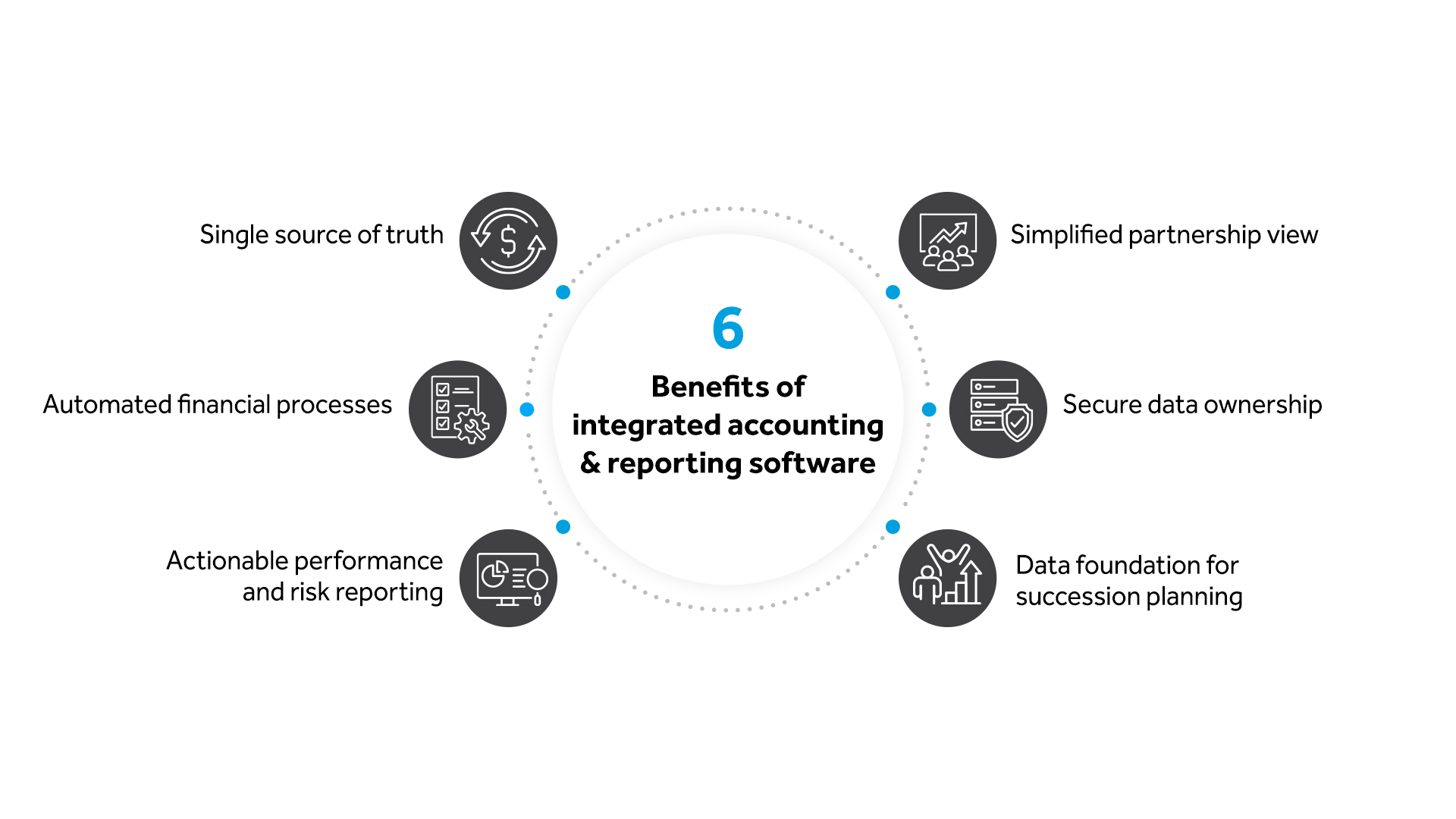

This lack of open conversation between the current and younger generation can be bridged by engaging an external advisor. However, a solid database is essential to ensure conversations happen based on concrete numbers and insights. Thankfully, family office software tracks financial data and provides actionable insights that facilitate effective conversations regarding succession and provide a consolidated view of assets for better tax planning. Additionally, advanced integrated accounting and performance reporting software, such as AV PRO provides access controls that enable the current generation to grant a customizable reporting view to their successors. This enhances the latter’s understanding of the family’s wealth structure, aligns their perspective with the family’s financial goals, and allows the current leaders to keep their data confidential and secure. Read this case study to learn how AV’s bookkeeping, reconciliation, and reporting features helped this Florida-based single-family office to make better financial decisions.

4.Control over portfolio

Since families have assets spread across different geographies and entities, which are managed by multiple advisors, they need a system to track and consolidate their portfolio to get a complete view of their investments.This helps make better investment decisions and manage risk efficiently. A family office software provides a 360° view of the family’s portfolio, enabling accurate cash flow projections, identifying income and expenses, determining exposure to risk, hedging against black swan events, and preparing asset re-allocation strategies.

5.Control and audited access to sensitive information

With instances of data breaches on a constant rise, one of the main concerns for families is to ensure that their information remains confidential and secure. Since family offices collaborate with multiple advisors, there is a high risk that unauthorized individuals could access their data.Thanks to the advanced built-in data security protocols in solutions like AV PRO family office software, families can limit what advisors are allowed to view by implementing access controls that provide a configurable view of sensitive data. It also features user roles and permissions to ensure access to sensitive data is granted only to authorized parties, along with an audit trail to monitor all user activity by session. With AV PRO, families can retain full ownership of their private data.

Conclusion

It is crucial for families to take wealth preservation as seriously as wealth generation. And the best way to do that is by establishing a family office with expert financial advisors and advanced software. AV PRO stands out as a leading family office software that has all the required capabilities to ensure a family’s assets are protected and grow with time.

Contact us today to explore AV’s powerful capabilities with a 14-day free trial.