Understanding Investment Policy Statement (IPS)

An Investment Policy Statement (IPS) is a document that outlines the investment goals, objectives, and strategies for an individual or an organization. It is a written statement that provides guidance on how investment decisions should be made and managed. The IPS serves as a roadmap for making investment decisions and ensures that all decisions are made in accordance with the investment objectives and risk tolerance of the investor.

The IPS typically includes information about the investor’s financial goals and objectives, investment time horizon, risk tolerance, and constraints. It also outlines the asset allocation strategy, which specifies the proportion of the portfolio to be invested in various asset classes such as stocks, bonds, and cash. Additionally, the IPS includes guidelines on how investment performance should be monitored and evaluated, and when and how changes should be made to the portfolio. Here are 7 points that help to understand IPS:

1.Objectives: The IPS should clearly state the objectives of the investment portfolio, such as capital preservation, income generation, or long-term capital appreciation.

1.Objectives: The IPS should clearly state the objectives of the investment portfolio, such as capital preservation, income generation, or long-term capital appreciation.

2.Risk Tolerance: The IPS should establish the investor’s risk tolerance and willingness to take risks. It should also specify the maximum amount of risk the investor is willing to take.

3.Investment Strategy: The IPS should outline the investment strategy, including the types of securities to be invested in, the geographic regions, and the sectors that will be targeted.

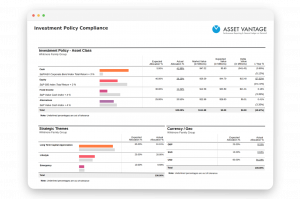

4.Asset Allocation: The IPS should establish the target asset allocation, which refers to the percentage of the portfolio to be invested in various asset classes such as stocks, bonds, and cash.

5.Performance Measurement: The IPS should define how the performance of the portfolio will be measured and evaluated. It should also specify the benchmark against which the portfolio will be compared.

6.Investment Manager Selection: The IPS should outline the criteria for selecting investment managers, including their investment philosophy, experience, and performance track record.

7.Review and Rebalancing: The IPS should establish a schedule for reviewing the portfolio’s performance and making any necessary adjustments, including rebalancing the portfolio to maintain the target asset allocation.

Conclusion:

An IPS is a crucial document that helps investors and investment managers to stay focused on the investment objectives and strategies. It provides a clear roadmap for managing the portfolio and ensures that all parties involved are on the same page. By adhering to the guidelines set forth in the IPS, investors can minimize the risks associated with investing and maximize their chances of achieving their investment goals.