Welcoming the Next Generation into Family Offices: A Strategic Imperative

According to research and consulting firm Cerulli Associates, USD 105 trillion is expected to flow to heirs through 2048. This large amount of intergenerational wealth transfer has made succession planning a major concern for family offices. Despite the urgency, 41% of families currently do NOT possess a sound succession plan while 50% of family offices lack a succession charter to guide the operations of their leadership team as per a report by Deloitte. This problem is further intensified by the fact that 41% of families are planning to pass the baton to their successors by the next decade. Without a well-structured framework to ensure seamless wealth transfer, family wealth is at stake. Considering these challenges, this blog will cover the following three important aspects:

1. Why 43% of families have made charting a succession plan as one of the top-most strategic priorities?

2. Why bridging the gap between the investment priorities of the current family principals and their heirs is essential?

3. Why comprehensive training and educating is compulsory to bring future leaders up to speed with the family’s financial goals?

4. How a succession planning family office software can play a crucial role in helping families streamline their succession journey.

Aligning next gens’ perspective with the family’s financial goals

The period of transition can be challenging for many families, often leading to conflicts that may escalate into lengthy court battles if not planned adequately. While the most forward-thinking families have successfully charted succession plans keeping in view their short- and long-term goals, these plans require constant updates, irrespective of whether they involve wealth transfers to the 2nd or 5th generation. Hence, careful planning, training, and an open platform for exchange of ideas between the current principals and next gens is vital to avoid potential conflicts.

This is where a structured family office comes to the rescue. They bridge the gap between the current principals and their potential successors by aligning their individual financial objectives with the family’s collective financial goals. Today’s generation, born and brought up in a digital-first world, consider themselves digital natives showing higher inclination towards riskier investments. As per a study by the fund administrator Ocorian, 66% of family office professionals highlighted that the next gen is more interested in digital assets compared to current family principals. A similar trend can be seen for private market investments 46% and impact investing 42% compared to traditionally deemed secure investments such as real estate preferred by their predecessors.

Equipped with a family office software, UHNW families can solve for succession planning by:

1. Creating and monitoring investment policy statements which ensure that successors, who have a higher risk appetite can align their investment strategies with the agreed-upon risk framework established by family principals.

2. Developing virtual sandboxes that simulate the impact of different investment vehicles, enabling both the generations to visualize the impact of their decisions.

3. Checking whether the portfolio is overweighted or underweighted by tracking expected versus actual allocations across asset classes, enabling strategic rebalancing.

Preparing future leaders through comprehensive education

The Top 10 family office trends 2024 report by Deloitte provides interesting statistics regarding next generation involvement, succession readiness, and challenges in succession planning in family offices.

Next Generation Involvement:

- 46% of family office boards include next-generation members.

- 26% of family offices are led by a next-generation CEO.

Concerns About Succession Readiness:

- 30% of Single-Family Offices (SFOs) believe future heirs are unprepared to succeed their predecessors.

- 28% think the next generation lacks the required financial literacy to take the lead.

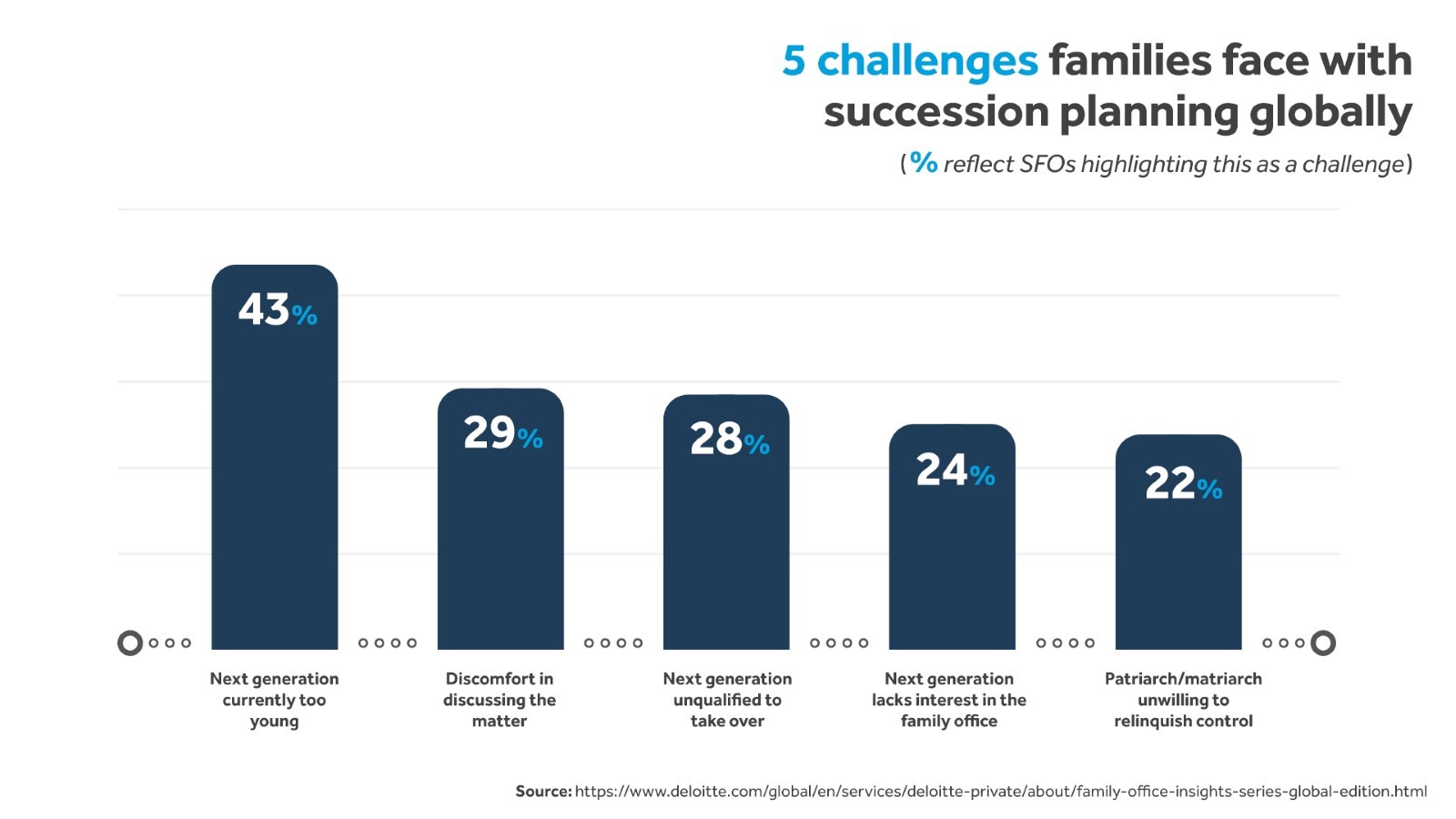

Key Challenges in Succession Planning:

- 43% of SFOs cite maturity of successors as the most important challenge.

- 28% highlight educational qualifications as a critical factor.

- 24% emphasize interest levels of future heirs as a key concern.

As the family grows larger with each generation, a great chasm emerges between their values, goals, and worldviews making it difficult to reach consensus on issues that matter.

The “Redwood” Program — A successful succession planning initiative

Family offices offer effective solutions to the challenges mentioned above by developing a strong bond between family members and by coaching them from a young age. An intriguing example comes from the Secretary General of a European family office, who oversees a program called “Redwood,” which brings together all 150 members of a family. Members between the ages of 16 to 32 meet twice a year where they discuss on pressing issues such as business processes, investments, and philanthropic initiatives. Members in this age bracket get a first-hand experience of working with the family business’ boards and receive scholarships for undertaking quality education, helping them develop critical skills required to effectively manage and oversee family operations when the time arrives. All the family members are also educated about their shared origins, which serve as a unifying thread that binds them together.

How AV facilitates succession planning for family offices?

Asset Vantage family office software facilitates seamless succession planning by providing the following benefits:

1. Next gens gain a clear view of the family’s wealth, enabling meaningful discussions with family principals on asset and wealth transfers.

2. Future heirs gain configurable reporting views allowing them to align their perspective with the family’s financial goals.

3. Families can minimize tax burdens during inter-generational wealth transfers, maximizing benefits for future heirs.

4. Enables families to grant limited access to legal representatives, aiding in heir identification, conflict resolution, and legal compliance.

Get in touch with us to know how Asset Vantage has evolved to become the platform of choice for 300+ family offices across 10 countries.

Start your journey with AV today.