Choosing the Right Portfolio Accounting Software for Family Offices

Family Offices today are significantly complex. They invest in multiple asset classes — liquid as well as illiquid — have multiple custodians and banks accounts, and manage their holdings through intricate entity structures. To effectively manage this complexity, it is imperative to have a single source of truth for strategic investment allocation, tax planning, and wealth growth and transfer.Hence, choosing the right portfolio accounting software for family office becomes crucial.

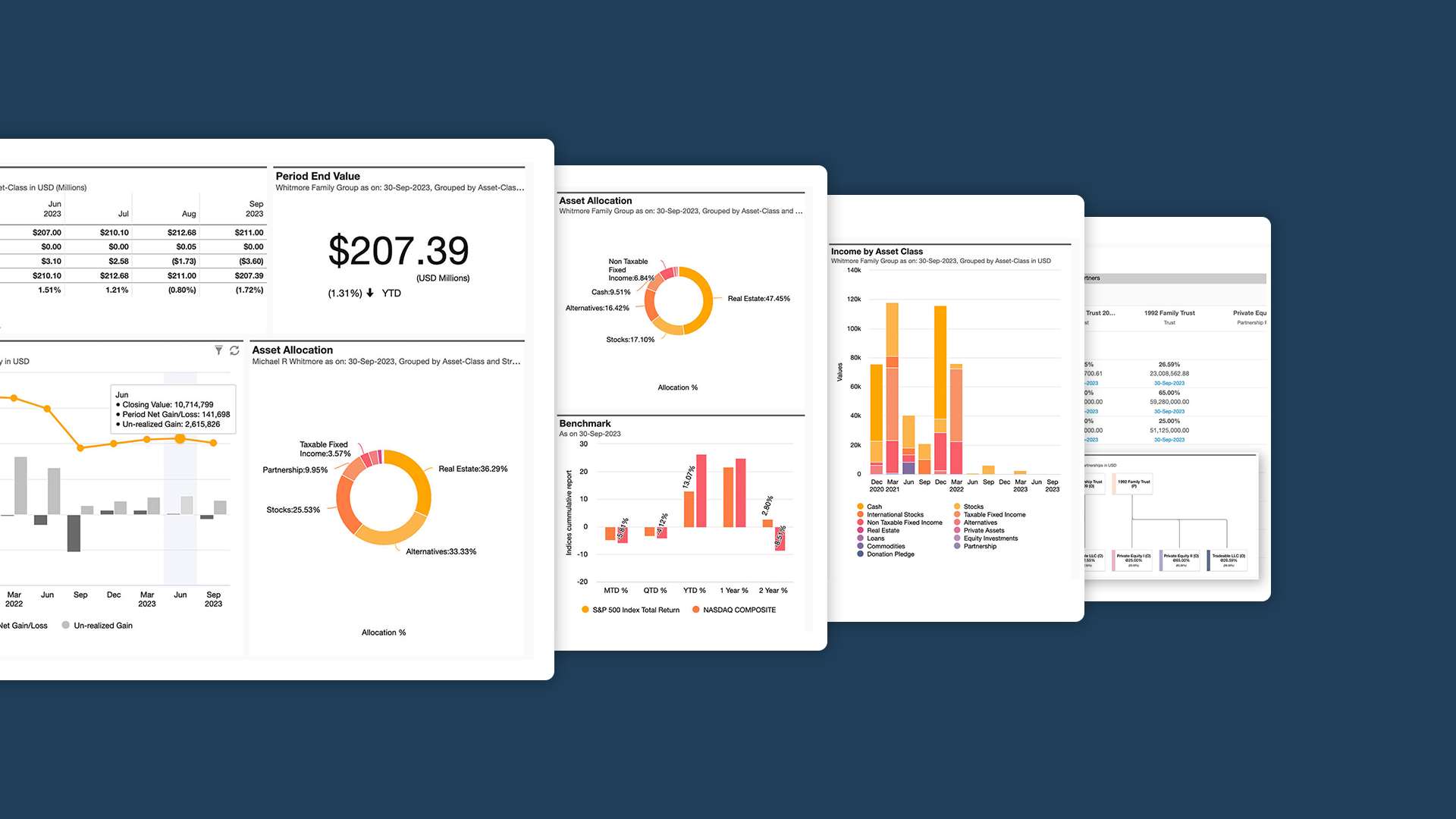

Investing in the right technology designed specifically for modern Family Offices is thus critical. An integrated system like Asset Vantage which combines investment accounting and portfolio management is the key to greater Family Office success.

With assets scattered across the globe and handled by various advisors, there’s a growing need for software that can automatically pull disparate information onto one system. Then, the system ought to provide highly-customizable investment analytics and reporting capability for a simple and actionable view of wealth. All of this has to further be underpinned with robust security features to protect confidential family information.

Harnessing such a tool helps family office principals better manage their wealth. Investment managers of such families too can spend more time on strategic tasks, build trust, and boost business growth.

Key Features to Look for in Portfolio Accounting Software

When choosing an investment portfolio accounting software for family offices, there are several key features to consider that can significantly enhance tracking and oversight of investments:

Comprehensive and Consolidated Reporting: It is essential to provide a single source of information across asset classes, currencies and entity structures. The platform should automatically pull data from various custodians and banks to record transactions. Such investment book-keeping also ought to follow the prevailing accounting standards. The system can then generate customizable reports which meet unique user needs.

Integration Capabilities: The software should offer should have in-built tools for data assessment, bill payments, what-if analysis, etc., or should be able to seamlessly integrate with such other systems. This enables better operational efficiency.

Also Read: A Comprehensive Guide to Tax Lot Method

User-Friendly Interface: The software should have features that are intuitive and easily understood. Users can thus quickly understand the tool and use it in a way that meets their individual needs.

Portfolio accounting software must prioritize strong security measures, including encrypted databases and communications, multi-factor authentication, and secure, VPN-only access options. It should offer advanced user access controls and robust audit trails compliant with regulations. Additionally, data integrity needs to be ensured through regular encrypted backups to maintain data safety and client confidence.

Real-Time Data Access: When it comes to investments, timing is critical. Always having the latest information on hand is therefore game changing. The software should be capable of providing dynamic tracking and analyzing features to make it quick and easy for the user to assess the investment performance, risk, and allocation at any time.

Scalability: As family offices grow in their complexity and their needs evolve, the software must be able to scale and adapt. This means it should be able to accommodate additional assets, markets, and investment strategies without compromising performance or usability.

Investing in the right portfolio accounting software is a transformative step for family offices. The features they have to offer will reduce a bulk of manual effort so principals and their managers can focus more on operations and strategy. With the perfect tool in their arsenal, family offices can achieve greater financial growth and freedom.

Also Read: Understanding Asset Management: Discretionary vs. Non-Discretionary

SPEAK TO US