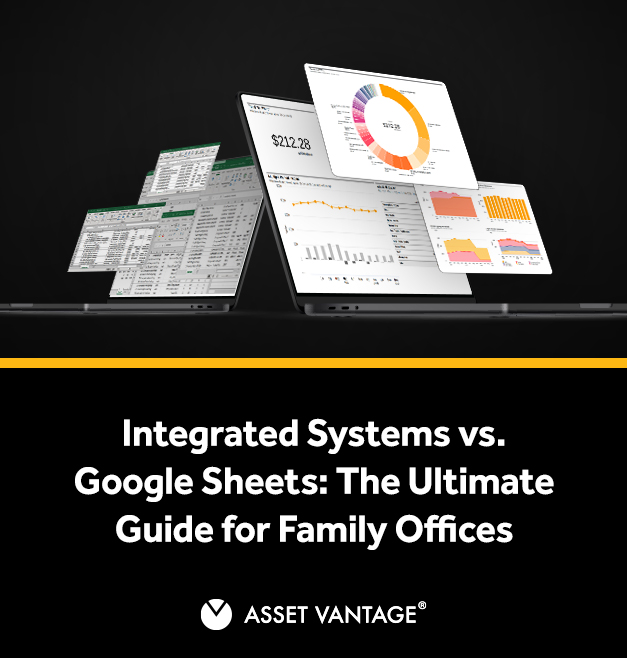

A Complete Guide to the Family Office Platform and Why Spreadsheets Don’t Measure Up

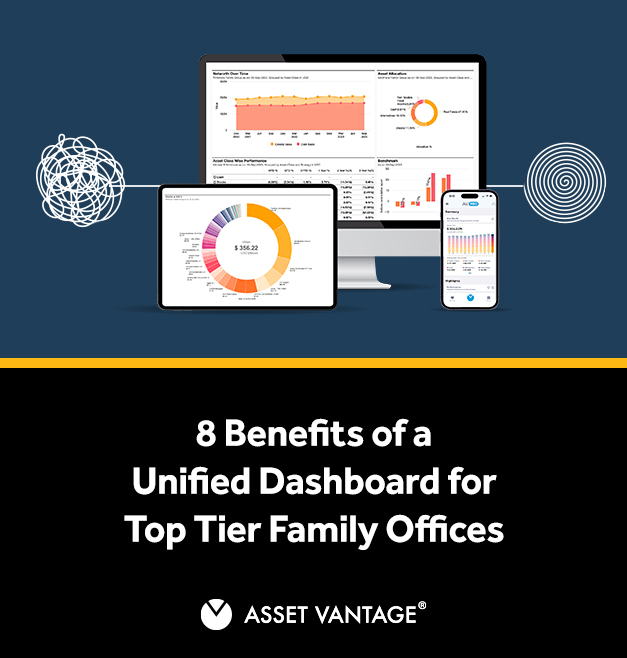

01 October, 2025Family wealth is more challenging to manage than ever. Single-family offices and multi-family offices balance equity holdings, private equity, and alternative investments while relying on spreadsheets that were never built for the task. Financial data gets scattered, investment management decisions slow down, and investment analytics...

READ MORE