Risk Management for Family Offices: Tackling Operational and Organisational Risks

The financial world is changing and it’s replete with risks. With stringent tax structures, differences in opinion between the current and next generation of leaders, a shortage of talented professionals, rising terror of cybersecurity issues, and increasing geopolitical tensions makes it challenging to judiciously allocate resources and identify the best investment strategies. Therefore, risk management for family offices is essential, and it’s crucial to explore solutions such as Family Asset Management Software to mitigate potential risks.

According to the 2024 Global Family Office Report, family offices have a broad understanding of their risks. However, they find it challenging to address their needs across three pivotal areas: cybersecurity (40%), family governance and succession planning (31%), and family wealth education (31%).

Top 5 risks that family offices encounter

As far as risk mitigation strategies are concerned, family offices must first change their mindset from “accepting the unexpected” to “expecting the unexpected.” This requires a deep understanding of how and where risks originate, how different risk domains are inter-related, the level of impact they can have upon the family’s wealth or operations, and their probability of occurrence.

Risk management for family offices is a significant issue that requires a project-level responsibility for effective management. But before that, it’s critical to understand the major risks that UHNW families face.

This article will focus in detail on the five operational and organizational risks, how they impact family office operations, and how Asset Vantage, a leading family asset management software helps alleviate them.

Also Read: Solving the Data Dilemma: Challenges and Solutions for Family Offices

What are operational and organizational risks?

Family offices, across a diverse range of AUM and operational complexities, face various types of operational and organizational risks. Operational risks involve failures in internal systems or unprecedented external events that can create obstacles in the daily operations of a family office, such as cybersecurity breaches, financial fraud, and failure to comply with regulatory requirements.

On the other hand, organizational risks consist of structural issues that can negatively impact the stability of a family office. They can arise due to generational differences in managing the family’s wealth structure and aligning with financial goals, an inability to attract talented and experienced professionals, and a lack of decision-making frameworks.

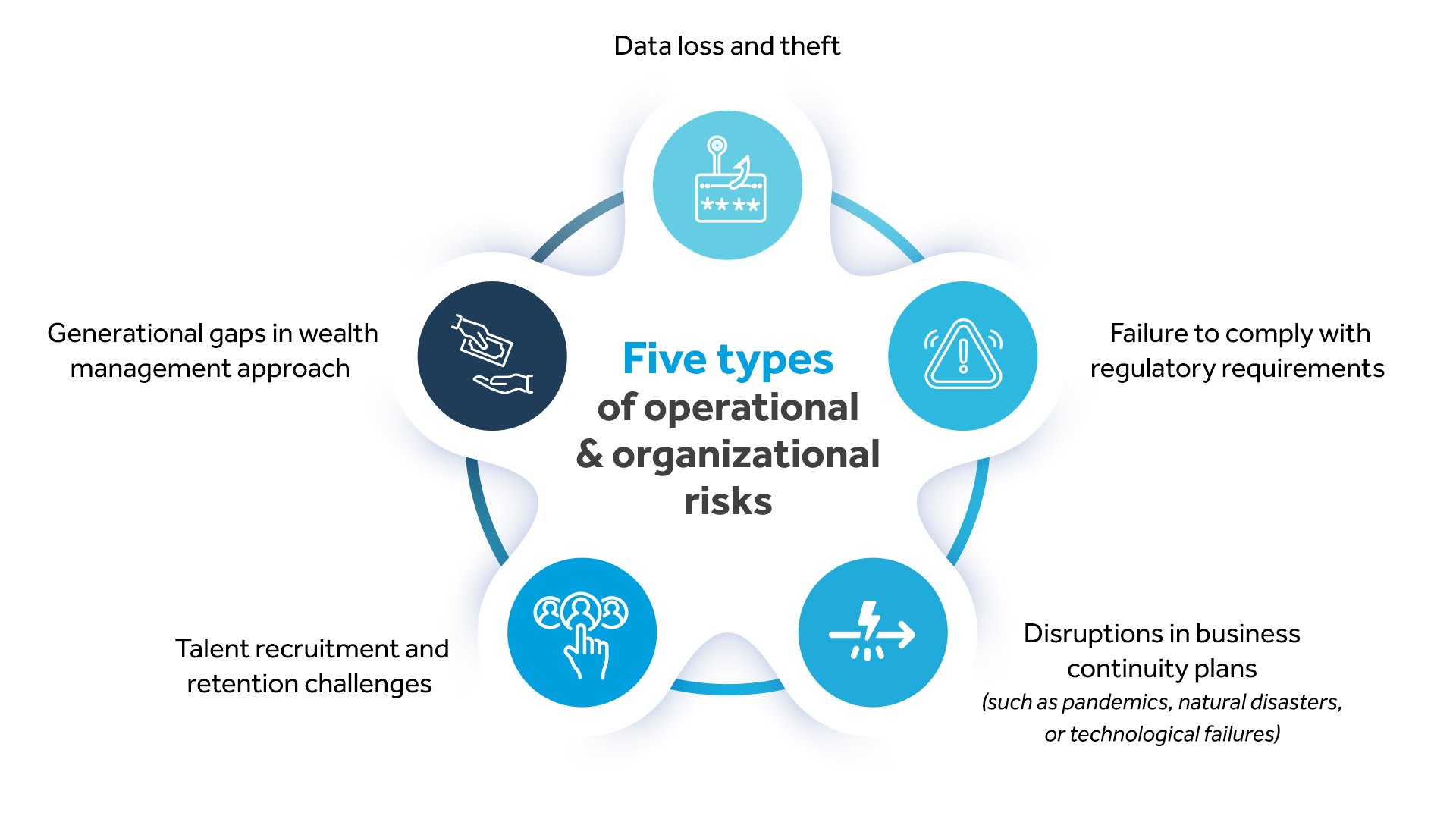

5 types of operational and organizational risks

1. Cybersecurity

Since most of the data is stored and accessed in digital form, data loss and theft are a major cause of worry for family offices. Therefore, a family asset management software that provides a comprehensive multi-layered approach to combat cybersecurity issues is essential. Creating a culture of security within organizations is also an effective step towards risk management for family offices as it educates employees about cybersecurity best practices such as identifying phishing attempts and creating strong passwords.

2. Compliance and regulations

Countries worldwide are formulating complex regulatory requirements such as stringent tax laws and anti-money laundering regulations. Failure to comply with them can lead to substantial fines, legal consequences, and reputational damage. The first step of the solution for family offices is to build configurable internal compliance procedures, conduct periodic audits, and constantly update themselves about regulatory changes. A family asset management software can support risk management for family offices by preparing financial records based on internationally accepted accounting principles like IFRS and GAAP, calculating tax liabilities, identifying tax-saving opportunities, and maintaining accurate financial records by updating their ledgers in real-time.

3. Operational resilience

The ability of family offices to serve their clients can take a “U-turn” due to disruptions such as natural disasters or technological failures. This calls for developing business continuity plans to ensure operations run disruption-free in case an unforeseen calamity occurs.

Operations can also grind to a halt if a key person leaves in an untimely manner as it can negatively impact relationships with important business associates. Therefore, maintaining updated records of client details and vendor contacts, cross-training employees to ensure uninterrupted operations, and developing a robust succession plan that builds the next generation of leaders to take on the responsibilities in the absence of key players is of great importance.

4. Talent management

Family offices usually find it difficult to recruit and retain talented professionals with years of experience in preserving and growing a family’s capital. This leads to a shortage of experienced individuals capable of providing relevant expertise. Some strategies that family offices can implement to offset this challenge are running talent development and upskilling programs to enhance the service quality of their existing staff, offering better compensation packages to recruit the best talent in the industry, and building a pro-employee culture that identifies their challenges and speedily addresses them.

5. Conflict of interest

Often times, family offices serve clients with multiple generations working together. In such scenarios, there is a high probability that conflicts may arise due to generational differences in approaches to wealth management. To make matters worse, a report by Deloitte reveals that 30% of family offices are not confident in the readiness of the next generation of leaders to succeed them, and 28% are of the opinion that the next-gen is unqualified to manage the family office operations. Conflicts of interest between generations can lead to disagreements over business strategies, conflicting management approaches, and the erosion of family wealth due to poor financial decisions. A family office software can reduce instances of generational conflicts by enabling the current generation to provide configurable views of family wealth to their successors, helping them understand the family’s wealth structure and align perspectives with the family’s financial goals.

How Asset Vantage helps in risk management for family offices

Asset Vantage is a SaaS-based technology that offers asset tracking, an integrated general ledger, and portfolio performance reporting features to single and multi-family offices, as well as individual wealth holders.

AV’s cybersecurity module, with its security, privacy, and auditability features is perfectly aligned for ensuring risk management for family offices:

— Reduces the risk of data breaches and cyberattacks by encrypting data to ensure sensitive information isn’t accessed by unauthorized individuals.

— Empowers families to choose what someone can see, edit, and delete across entities through access controls that provide a configurable view of sensitive data to third parties.

— Ensures peace of mind by maintaining an audit trail to track data activity by user session.

Another important challenge we have talked about in this article is regarding conflict of interest that arises between the current generation and the next gen of leaders in a family office. Thankfully, a family asset management software like AV helps bridge the gap by:

— Ensuring the next gen can engage in meaningful conversations on crucial topics such as asset and wealth transfer, supported by a simplified view of the family’s liquid and illiquid assets including beneficial ownership in one place.

— Allowing family principals to grant customizable reporting views of family wealth to the next gen by providing them individual login credentials. This helps keep an audit trail to track data activity by user session, ensuring only the right stakeholders have visibility to sensitive data while also ensuring successors gain a view of their respective holdings to develop an understanding about the family’s wealth structure and align their perspective with the family’s financial goals.

— Facilitates long-term scenario planning by assisting families in optimizing tax strategies, ensuring their successors receive maximum benefits. This enables a smooth handover of wealth across generations.

— Grant legal representatives limited viewing rights to specific asset classes owned by the family, enabling them to assist in succession planning by minimizing inheritance tax, ensuring compliance with legal regulations, resolving disputes, facilitating ownership transitions, and safeguarding assets from potential claims.

A key risk that we touched upon in this article is compliance with stringent regulatory requirements, which if not adhered to can lead to substantial fines and reputational damage.

Also Read: Why is Succession Planning Crucial for Single and Multi Family Offices?

Here’s how AV, a leading family asset management software enables family offices to manage regulatory risks:

— It mitigates the risk of maintaining critical records by tagging documents to specific transactions, enabling a swift response to audit requests.

— It ensures compliance with international accounting standards such as GAAP and IFRS, ensuring family offices remain accountable and well-prepared for regulatory reviews.

— It minimizes errors and reduces manual data entry by enabling the automatic updating and reconciliation of financial data, ensuring regulatory submissions are complete and error-free.

To get a detailed understanding of why Asset Vantage is an ideal solution for risk management for family offices, contact us today.

Speak to Us