Who’s Looking at Your Family’s Financial Data?

According to IBM’s 2024 Cost of a Data Breach report, the average cost of a data breach in the financial sector reached $6.08 million. This stark figure highlights the importance of comprehensive data protection for family offices. Securing financial data should be a top priority not just to prevent loss, but to preserve family legacy and ensure that sensitive information remains protected.

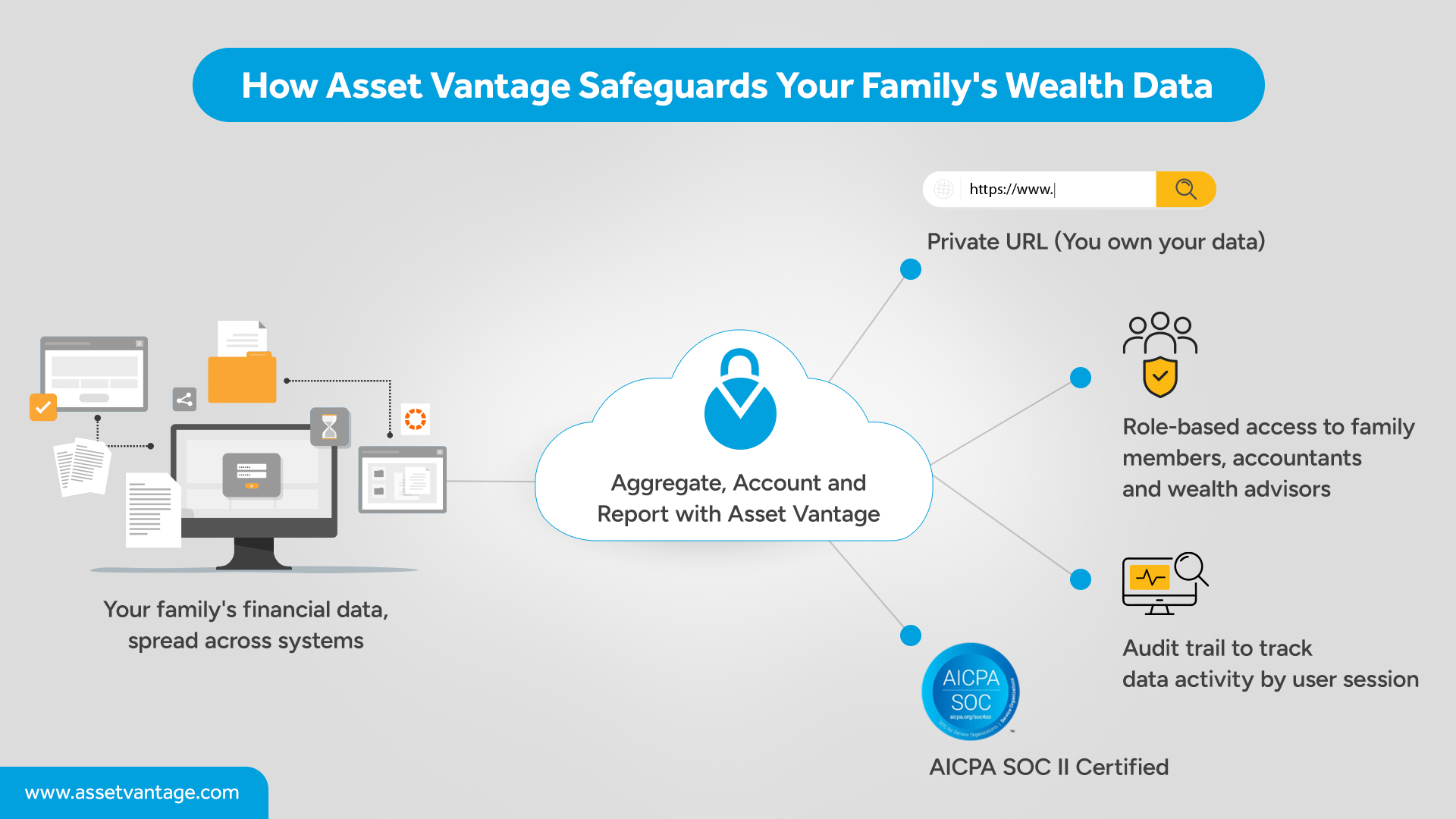

In this blog, we will discuss the various individuals who have access to your family’s financial data, the risks associated with exposing that data, and how Asset Vantage can help safeguard your family’s financial privacy through secure, centralized systems.

Who Has Access to Your Family’s Financial Data?

Understanding who has access to your family’s financial data is the first step in protecting its financial privacy. Many individuals and professionals will need some level of access, but it must be carefully controlled.

1. Internal Stakeholders: These are family members directly involved in managing wealth, including family office principals, their spouses, and heirs. Each member may have different responsibilities and needs for access, which should be clearly defined and managed.

2. External Stakeholders: Professionals such as accountants, tax advisors, investment managers, and legal consultants require access to specific financial information to effectively do their jobs. However, access should be limited to what is necessary to ensure data security.

3. Regulatory Bodies: There will always be a need for oversight by regulatory authorities, but access to sensitive data should be limited to only what is necessary to comply with legal and tax requirements.

Recommended: Best Investment Management Software for Family Offices

The Risks of Exposing Family Financial Data

When financial data is not properly managed, the risks to financial privacy can be severe. Here are five key risks of exposing sensitive financial information, followed by how Asset Vantage addresses each challenge:

1. Data Fragmentation

When financial data is spread across disparate systems or stored in disconnected locations, it becomes harder to manage and more prone to errors. Fragmented data can also lead to inefficiencies and increased risks of breaches.

How Asset Vantage Helps: Asset Vantage Family Office Software is designed from the ground up to integrate data aggregation, accounting, performance reporting and document storage in a single, unified platform with high levels of privacy and security. AV’s Document Vault feature further enhances efficiency by allowing users to securely upload, tag, and save important documents to specific transactions, investment holdings, or entities—eliminating fragmented record-keeping. Additionally, Asset Vantage’s bank sync feature and data feed engine automate the aggregation of data, further streamlining operations and ensuring a single, reliable source of truth.

2. Unauthorized Access and Evolving Family Dynamics

Unauthorized access and changing family dynamics both pose challenges that need to be addressed to ensure financial privacy and security. The first step in protecting financial data is clearly defining who needs access and why, and ensuring that the right permissions are set accordingly. This is especially important as family structures evolve—new heirs, changes in ownership, or new family members joining the financial management team—requiring flexibility in how access is managed.

How Asset Vantage Helps: Asset Vantage secures your financial data with SOC 2-certified encryption and secure private cloud, protecting both in-transit and at-rest data. Through its role-based access controls (RBAC), family offices can define roles for each individual, from family members to external advisors, and set specific permissions based on their responsibilities. Whether it’s allowing family members to view high-level reports or giving accountants access to detailed financial statements, these permissions ensure that only the necessary people have access to sensitive information. As the family dynamic changes, Asset Vantage allows administrators to easily adjust access levels—whether adding new heirs or adjusting the role of a family member—without compromising security.

3. Data Misuse and Mistakes

Even when data is accessed by trusted individuals, there is a risk that it may be misused or mishandled, whether by accident or with ill intent. Such misuse can result in financial errors, tax discrepancies, or legal issues.

How Asset Vantage Helps: Asset Vantage provides detailed audit trails that track every action taken on financial data, from viewing to editing and sharing. This level of transparency ensures accountability and allows principals and/or CIO to easily monitor how data is being handled. By providing complete visibility, Asset Vantage reduces the chances of misuse and ensures compliance with internal governance rules, maintaining financial privacy and security.

Must Read: Why a Family Office Software is Critical for Protecting, Growing, and Sustaining your Wealth

4. Legal and Tax Consequences

Improperly handled data can lead to significant legal and tax implications, including audits, penalties, and compliance issues. Financial misreporting or mistakes can result in costly fines and damage a family’s reputation.

How Asset Vantage Helps: With Asset Vantage, managing compliance is more robust. The platform’s automated reporting tools generate IFRS and GAAP-ready reports, ensuring that all financial data is correctly documented and complies with international accounting standards. This reduces the likelihood of errors and facilitates smoother audits, protecting families from potential legal or tax issues, ensuring the financial privacy of their wealth.

Conclusion

Protecting your family’s financial data is not just about safeguarding wealth, it is also essential to maintaining the trust, security, and legacy that are core to your family’s values. By understanding who has access to your sensitive financial data and implementing proper safeguards, you lay the foundation for enduring financial privacy.

Asset Vantage provides a comprehensive solution to these challenges, offering secure encryption, centralized data management, flexible access controls, and real-time audit trails. With Asset Vantage, you can trust that your family’s financial information is handled with the utmost care and confidentiality, giving you peace of mind for the future.

If you are ready to ensure that your family’s financial privacy is protected, we invite you to explore a personalized demo of Asset Vantage and see how it can support your family’s unique needs.

Speak to Us