The Hidden Costs of Disorganized Financial Data in Family Offices

When deals are presented to family offices, they need to evaluate their exposure to those specific asset classes, cashflow to fund the opportunity and measure other variables that impact the decision. Unfortunately, the team scrambles to verify risk exposure, pulling reports from disconnected systems, manually reconciling figures, and cross-checking spreadsheets. This leads to delayed decision making often relying on siloed data.

They’re not alone. A 2024 Deloitte Family Office Report found that wealth management teams lose 12 hours per week searching for accurate financial data. That’s a staggering 600+ hours a year lost due to inefficiencies. Instead of focusing on strategic growth, teams are stuck chasing numbers. The root cause? A reliance on disconnected systems and manual reporting processes.

Family Offices Are Managing Billions on Disconnected Systems

Despite overseeing vast wealth, most family offices don’t operate with the structured financial frameworks relied upon by institutions. They use multiple software solutions for accounting, investments, and portfolio management but these systems aren’t integrated. Teams manually compile reports, reconcile inconsistencies, and verify figures across multiple platforms.

Family offices don’t just need faster reporting, they need a single source of truth for their data. The true cost of fragmented financial data goes beyond inefficiency. It can lead to missed investment opportunities, slow execution, compromised risk management, reactive decision-making, and wealth transfer issues for the next generation. In fact, The Family Office Operational Excellence Report 2024 highlights that 40% of family offices still rely on spreadsheets, while 38% manually piece together data from multiple sources. Without structured intelligence, family offices lose control over their financial picture, putting both decision-making and generational wealth at risk.

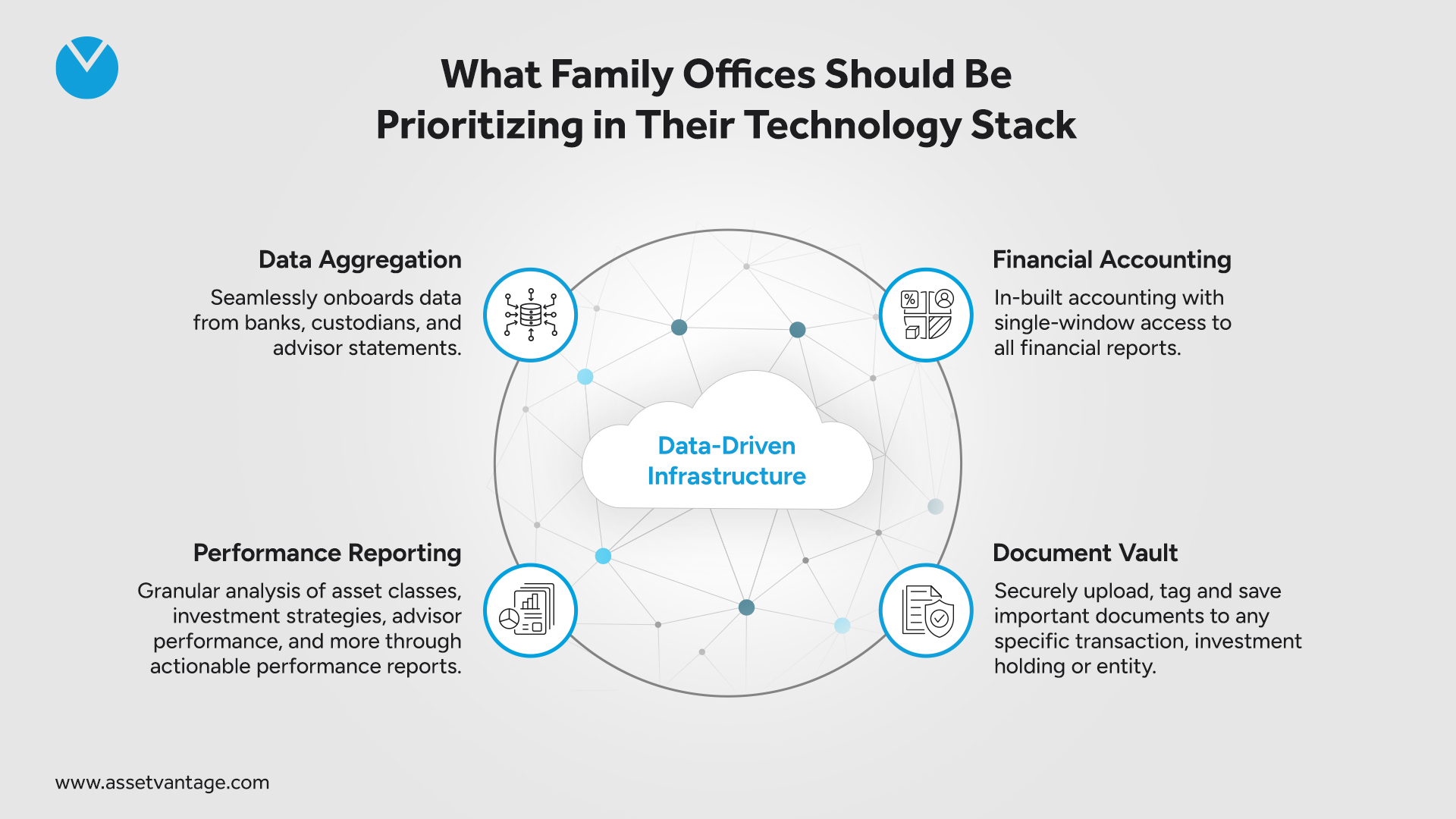

What Family Offices Should Be Prioritizing in Their Technology Stack

More than new technology, family offices need the right approach to data. Here’s what should be non-negotiable:

1. Data Aggregation: Seamlessly onboards data from banks, custodians, and advisor statements.

2. Financial Accounting:In-built accounting with single-window access to all financial reports.

3. Performance Reporting: Granular analysis of asset classes, investment strategies, advisor performance, and more through actionable performance reports.

4. Document Vault:Securely upload, tag and save important documents to any specific transaction, investment holding or entity.

When the data speaks a clear truth, indecision vanishes. Conversations shift from “whose numbers are right?” to “what’s our next move?”

The Future Belongs to Data-Driven Family Offices

A rapidly shifting economic and geopolitical landscape, fast-moving PE, VC and real estate deals requiring real-time insights, and rising regulatory pressures, including complex tax laws and compliance demands are just some of the factors that influence data adoption in family offices.

By adopting a centralized, real-time approach to data, family offices can move beyond fragmented systems and manual reconciliations. Instead of chasing numbers, they can focus on the bigger picture, including strategy, risk management, and long-term wealth preservation. Family offices that embrace structured intelligence act with precision. Those that don’t? They’re left reacting to yesterday’s data.

The future belongs to those who take control of their data today.

Speak to Us