Tracking your portfolio in turbulent times – Period IRR

Period IRR (Internal Rate of Return) is the universally accepted financial metric to evaluate portfolio returns in turbulent times. Simply speaking Period IRR is a percentage value that shows the return on capital. This includes all cash flows and the compounded effect of gains and losses, for a specific period. You can calculate Period IRR at a total portfolio, asset-class, advisor or individual asset level.

Off late there have been several unexpected events that have caused a ripple effect across Indian and international markets. Think of Brexit, Demonetization, Trump’s landslide election and unconventional policies and the Goods and Services Tax (GST). Or how the reintroduction of long term capital gains will affect your portfolio. You would have to be clairvoyant to foresee these events or the market’s reaction to them. But using Asset Vantage software, you can measure the impact of these events on your portfolio and take appropriate action.

IRR itself is complicated enough to calculate in excel, but calculating period IRR manually is a laborious activity. This increases especially for complex portfolios with regular trading or churn. The complexity of calculation is one of the reasons why most online portfolio services, mutual funds and wealth advisors only calculate and display annualized returns since inception.

Technology to ease out getting Period IRR

Period IRR, at aggregate strategy, account, advisor or asset class levels, is available to Asset Vantage clients using the Portfolio Performance Summary report. The report gives comparative returns for the selected period and since inception, grouped according to your selection.

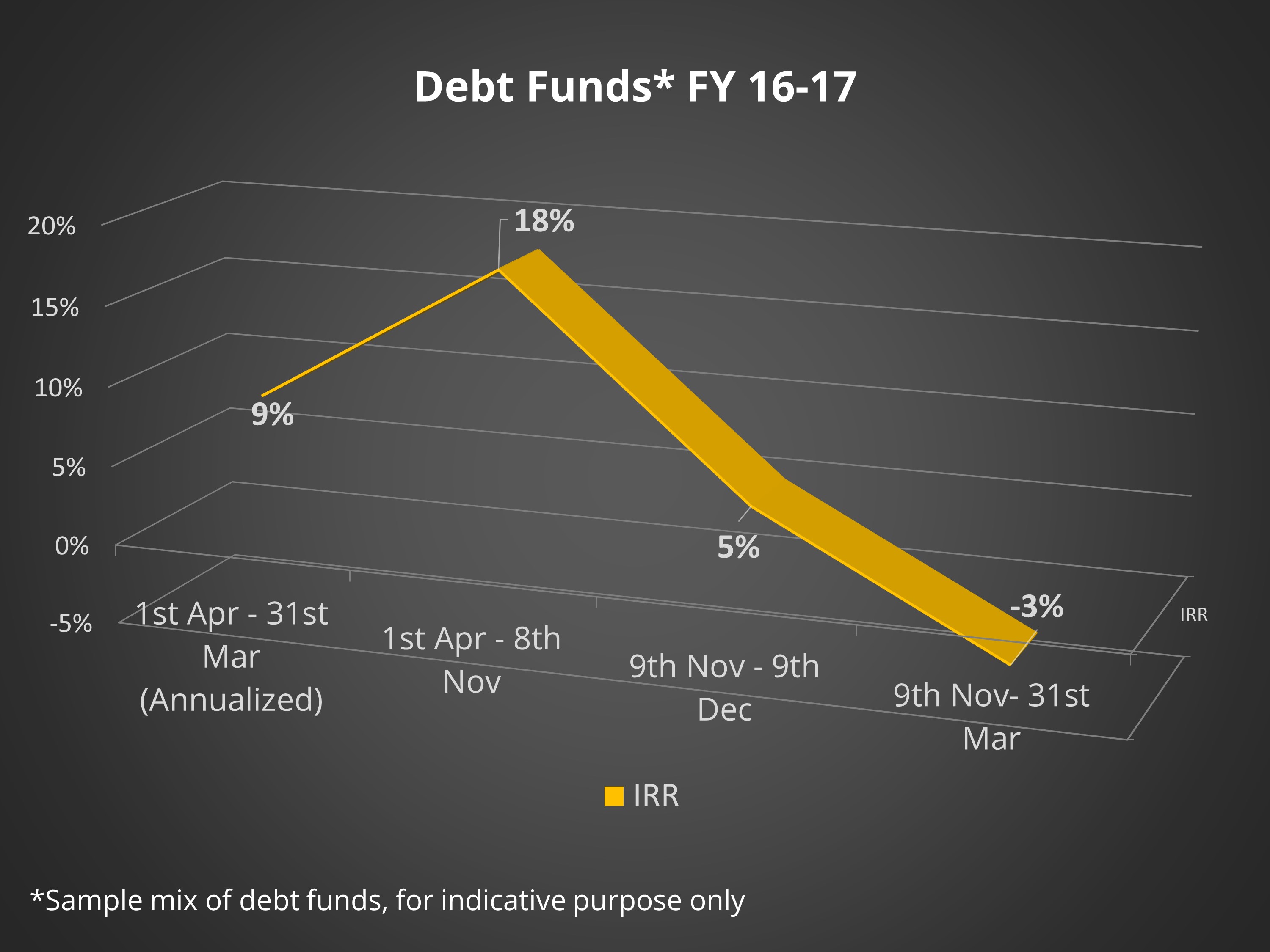

Consider the effect of demonetization on debt funds. If you’d only been looking at annualized IRR it never fell below 9%. This might have made you happy with the return. But tracking Period IRR would have revealed the decline in IRR post demonetization and prompted you to reallocate your investments to a more profitable asset class.

Similarly you could evaluate the performance of multiple advisors across the same period. This will help to assess their agility and the resultant effect on your portfolio.

Remember Peter Drucker’s famous quote, “What gets measured, gets managed”. If you aren’t using the right metrics to monitor your portfolio in periods of uncertainty, will you be able to take the right decisions to manage your wealth?