The Financial Operating System for Modern Family Offices and Their Advisors

AV unites general ledger and performance reporting

into a single source-of-truth platform built for family offices

Leading Family Offices Trust Asset Vantage

on Platform

Customer Presence

on Platform

Run a family office like a business with a clear, real-time view of net worth, capital flows, performance, and tax exposure across all entities.

With audit-ready books and full data ownership, make confident, well-informed financial decisions.

Built by the Family Office of a Tech Group, Trusted by Family Offices Worldwide

Asset Vantage, A UNIDEL Company, was created to produce what could not be found elsewhere: a full and actionable view of all its assets and liabilities.

The family office of a tech group, frustrated by tedious manual workflows, built its own answer to scattered data and hidden risks. That answer became Asset Vantage: general ledger accounting and reporting software that brings clarity to modern wealth.

All-in-One Family Office Software

Dive into key analytics of your investment portfolio,

stay connected on-the-go, and experience secure, seamless control like never before

The Integrated Software

of Choice for Modern Family Offices

General Ledger Accounting + Performance Reporting + Documents

Multi-Entity

Consolidation

Data Aggregation

& Reconciliation

Integrated

General Ledger

Portfolio

Performance

Partnership

Accounting

Check Writing/

Bill Pay

Private Equity

& Alternatives

Document

Vault

Managed

Services

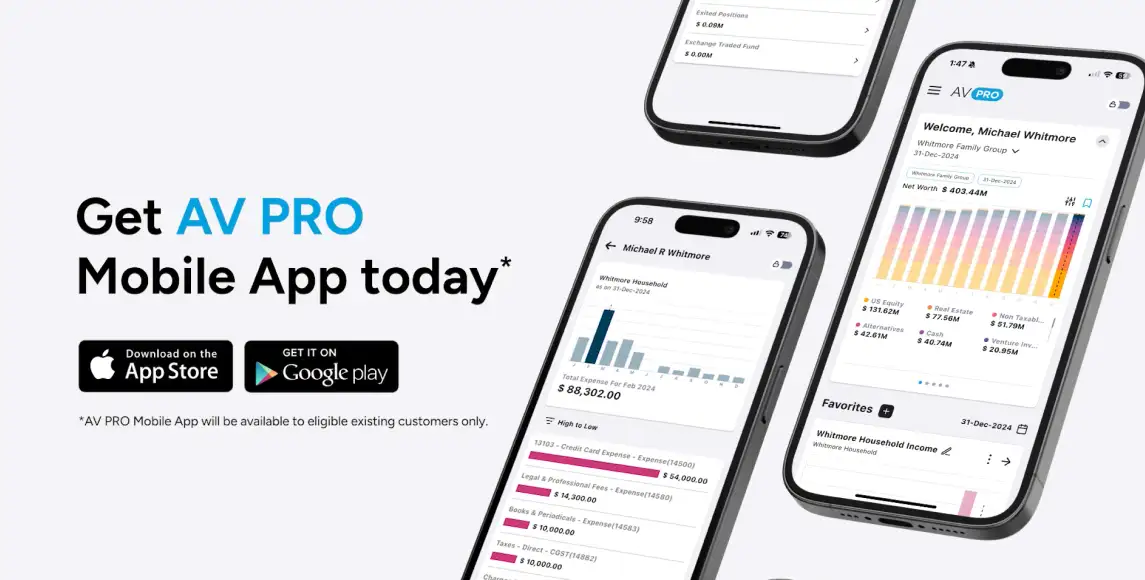

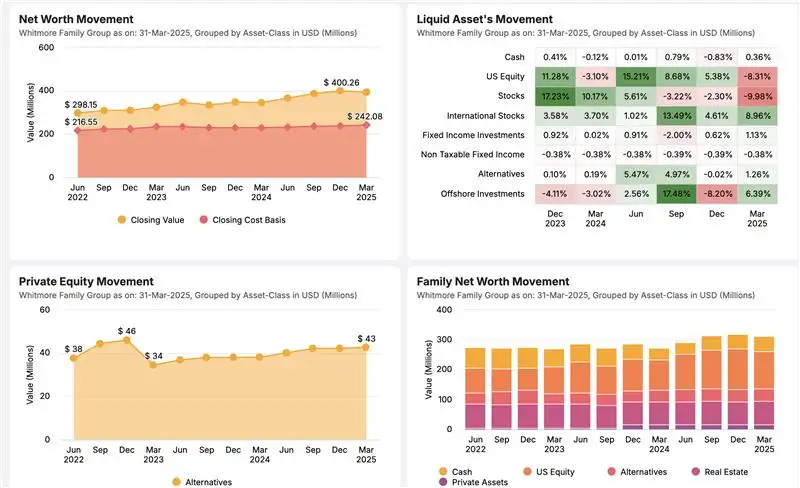

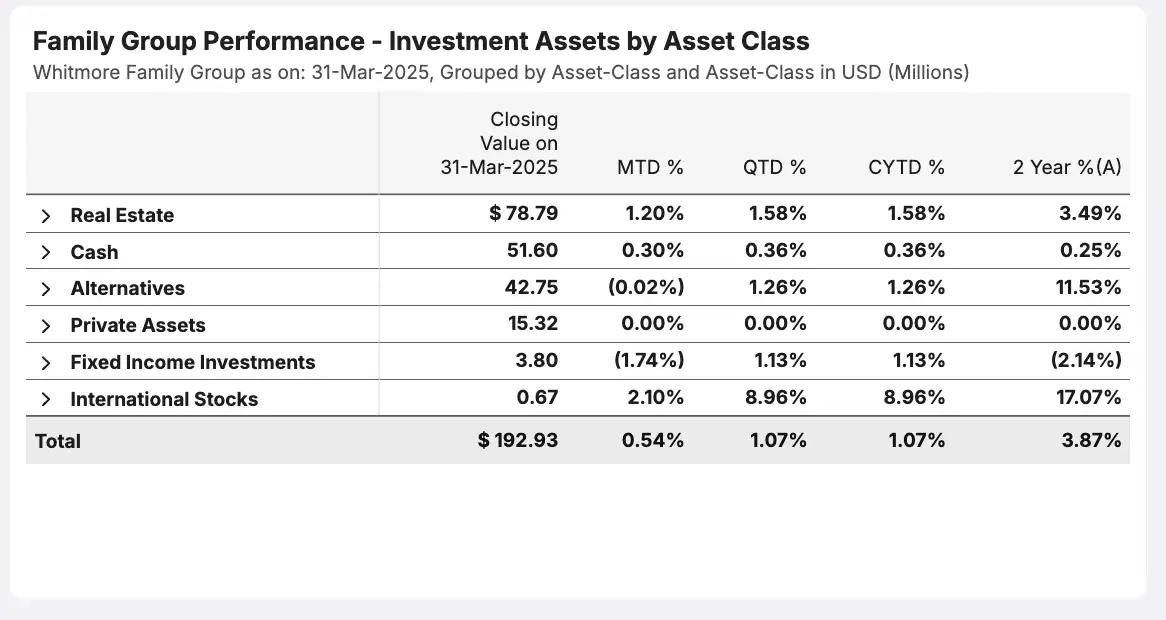

Powerful Insights With Fully Configurable

Multi-Entity Reporting

- Interactive dashboards with data visualization across all asset classes

- Flexible filtering and grouping by time period, asset type, entity, or custom parameters

- Comprehensive performance tracking including returns, allocations, and net worth trends

- Multi-dimensional analysis of investment performance, liquidity, and asset movements

- Forecasting tools for strategic planning

- Export capabilities for presentations and stakeholder communications

- Side-by-side comparisons across portfolios, time periods, and benchmarks

- Customizable views for different stakeholders (family members, advisors, trustees)

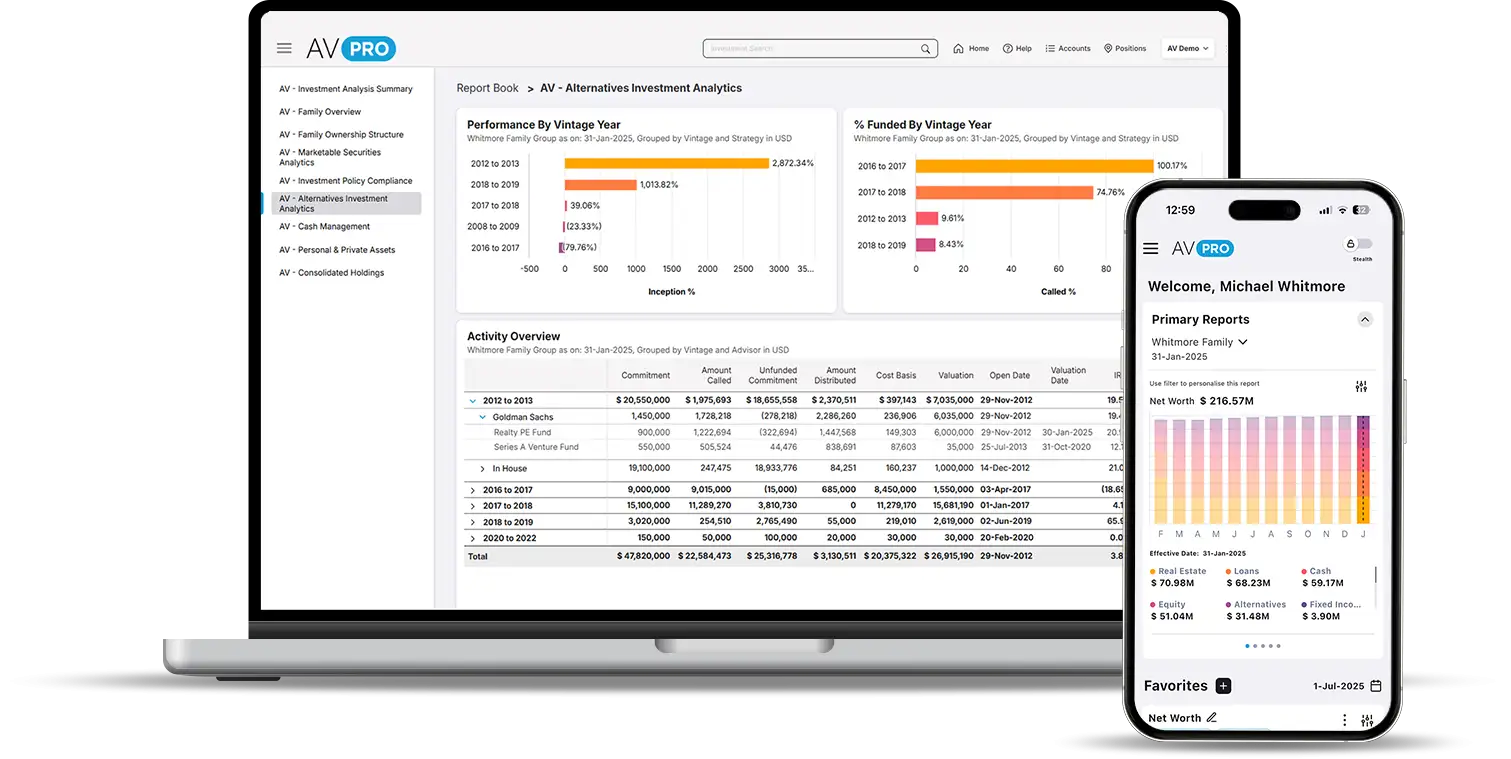

Financial Data Aggregation & Reconciliation

- Electronic T+1 or T+2 custodial and bank data feeds with authorizations

- Direct checking account and credit card account integrations

- Support for hundreds of PDF fund statements and trade confirmations

- Corporate action feeds to help post missing transactions

- Auto-generated GL posting for every transaction/cash flow

- Custodian tax lot and cash reconciliation reporting

- Bank reconciliation with clear dates

Integrated General Ledger

A single point of book-keeping built on global IFRS and GAAP standards, ensuring seamless integration and automation of the GL with the investments across tax entities.

- Custody Book of Record (CBOR)- Record multi-asset type financial transactions

- Investment Book of Record (IBOR)- Map investment transactions directly into the general ledger

- Accounting Book of Record (ABOR)- Ensure synchronized accounting books with portfolio performance

Portfolio Performance

- True multi-period time weighted returns

- IRRs and PME benchmarks for illiquid and real assets

- Sequential and cumulative multi-period performance

- Roll-forward valuations for illiquid assets

- Aggregate performance through dynamic groupings

- Reporting in both local and consolidated multi-currencies

- Performance with look-through into partnership holdings

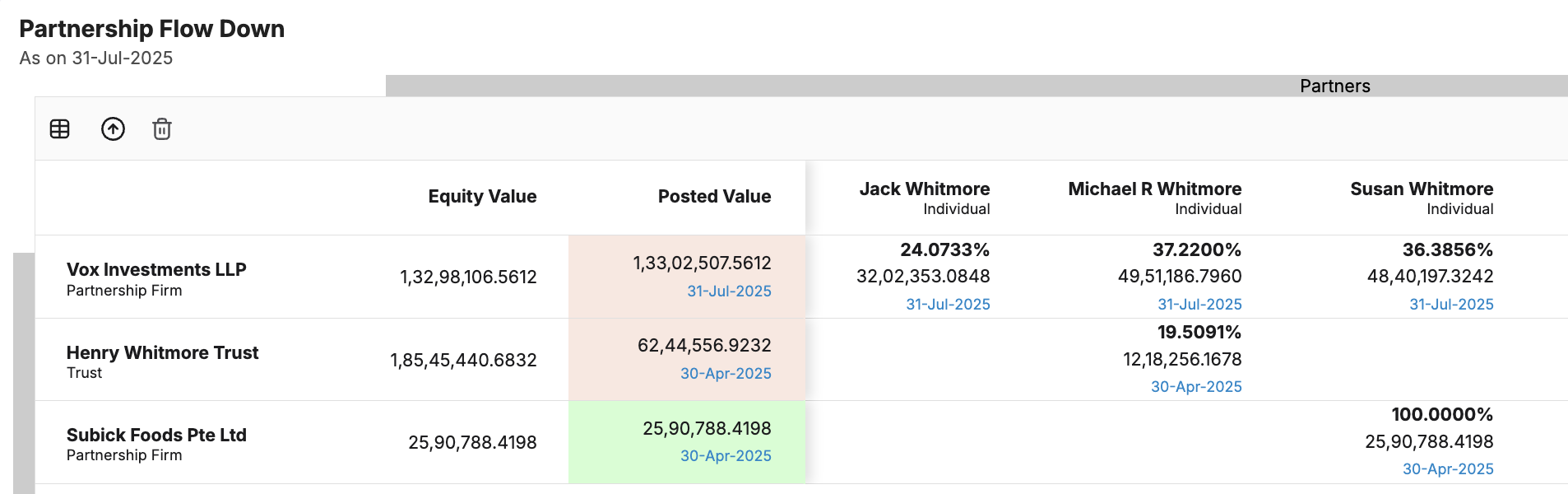

Partnership Accounting

AV’s partnership accounting feature provides clients with the ability to account for and manage their family investment partnerships.

- Powerful inter-entity transactions make complex structures easy to track and manage

- Capture direct partnership, side-pockets, GP and LP ownership through multiple levels and beneficial ownership of trusts

- A true general ledger enables dynamic changes in ownership over time and the ability to review historical allocation reporting

- Auto-posting of partnership valuations keeps the inside and outside basis and value at par

- Consolidating balance sheets with dynamic eliminations make reporting on complex structures a breeze

- Measure per-fund and per-investor performance across all the holdings

Check Writing/Bill Pay

- Streamline payments from multiple bank accounts and entities

- Print checks and integrate with 3rd party bill pay systems to track vendors and expenses

Private Equity & Alternatives

- Track any investment with commitments, drawdowns, distributions, recallable with cost / tax basis adjustments

- Commitments & unfunded commitments

- Vintage wise & J-curve reports

- Segregate change in value to net capital and gain/loss

- Track investment multiples, IRRs, PME benchmarks and more

- Tag fund reports and documents with each transaction

- Powerful tagging allows tracking real estate or venture investments that behave like private equity investments

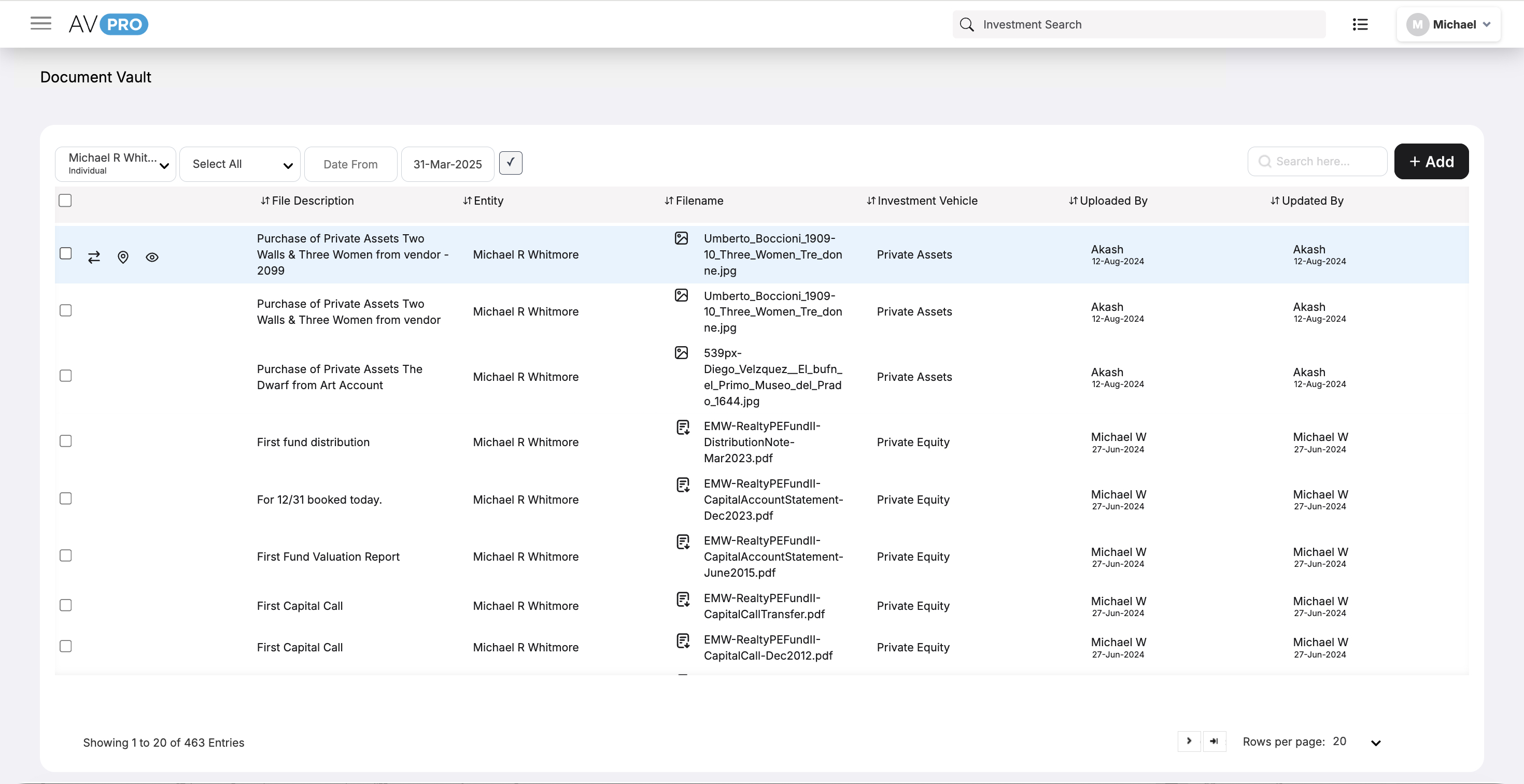

Document Vault

- Acts as a central repository to organize and track all document types across entities, groups, and transactions

- Maintains role-based permissions for uploading, previewing, downloading, and deleting files

- Enables quick search and preview through smart filters and document tags

- Supports secure bulk downloads with complete audit traceability for compliance and control

Managed Services

- Delegate day-to-day accounting, reporting, and reconciliations to our expert team

- Reduce key-person risk and ensure continuity with white-glove services

- Focus on strategic decisions while we handle the operational load

The Intelligence Driving Modern Family Offices

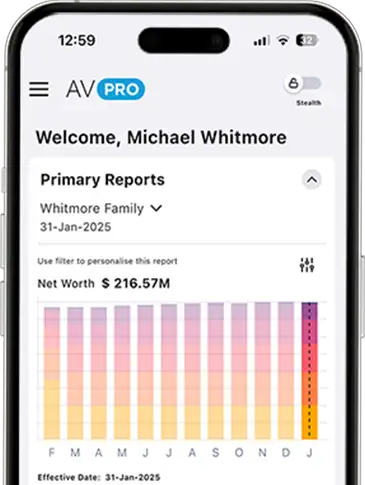

AV Mobile

Stay connected to your portfolio insights anytime, anywhere.

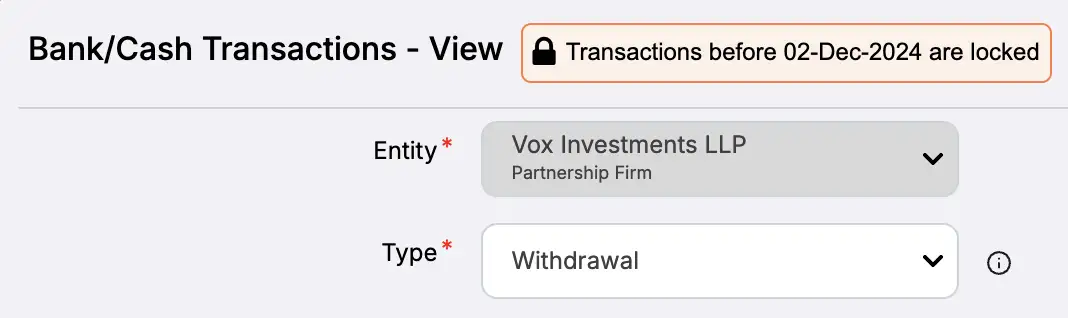

Locked Past Periods

Prevent accidental or unauthorized changes to closed periods.

Visual Performance Analytics

Track by asset class, advisor, and against benchmarks with visualized reporting including- heat maps, bar, and line charts.

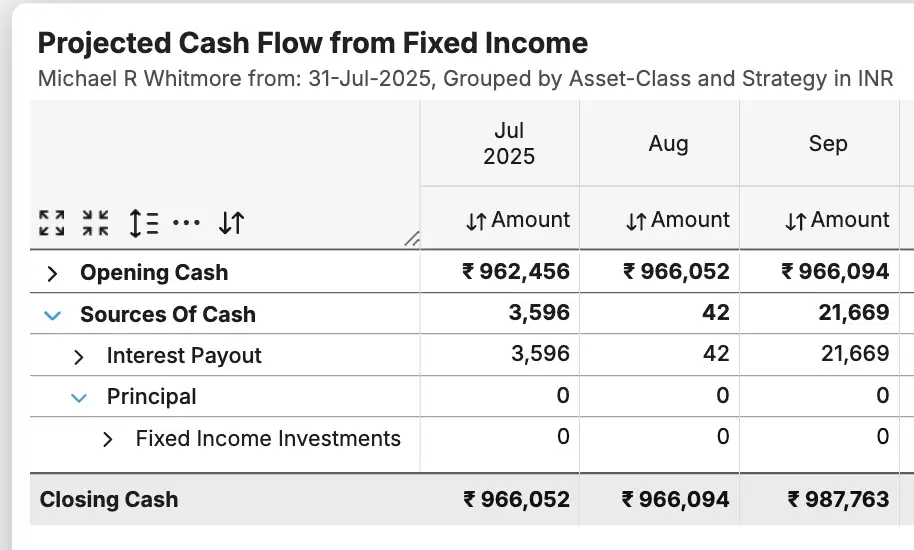

Cash Flow Forecasting

Project future cash-inflows for better liquidity management.

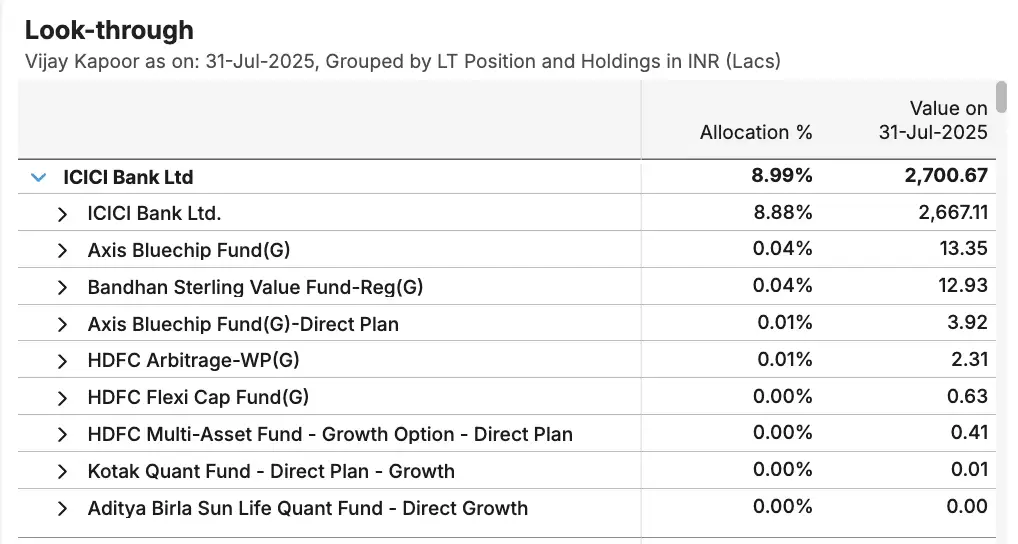

Look-Through

Get a transparent view of direct and indirect exposures of all underlying securities within mutual funds.

Investment Policy Statement Compliance & Benchmark Alignment

Instantly compare allocations to targets and track adherence.

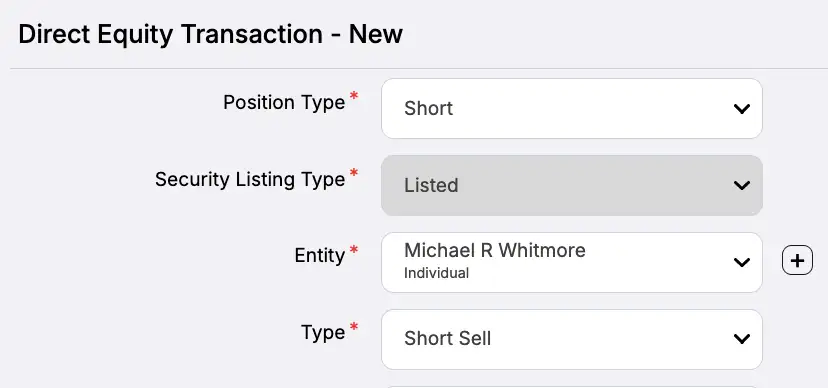

Short Position Tracking

Daily MTM insights for precise reporting.

Multi-Period Performance with Benchmarks

Track sequential performance and cash-flows with benchmarks across months, quarters and years.

Track Income & Expense with Ease

Create multiple configurable views of cumulative income and expense across entities and accounts.

One-Click Partnership Valuations

Post valuations across multi-level ownership structures in seconds.

What Family Offices Say

About Asset Vantage

Success Stories From Global Family Offices

How a Chicago-based Accounting Firm Replaced Spreadsheets with an Integrated Family Office Platform to Achieve Scale, Efficiency, and Client Trust

Helping an Asia-Based Family Office Unify Data and Streamline Compliance for Faster, Better Decisions

All Your Questions, Answered

1. Is Asset Vantage a wealth advisor or robo-advisor?

2. Why should I be using Asset Vantage?

If you’re looking to consolidate investment data, manage accounting and store your documents all on one platform, the Asset Vantage platform is the perfect solution. It will help you reduce complexity and stay in control of your data.

With AV, you will be fully protected against personnel changes in your family office, ensuring a seamless transition of users with no loss of historical knowledge or data.

AV offers users the ability to access the system anytime and anywhere, reducing dependencies on family office teams, wealth managers, and external advisors.

Your family succession plan will be streamlined with AV, consolidating all your financial and investment data in one place for seamless access.

3. Can I transact through the platform like buy/sell stocks and bonds or make bank transfers?

4. What type of entities and asset classes can I use Asset Vantage for?

Non-standard asset tracking is challenging for all family offices. Asset Vantage’s portfolio reporting software integrates all asset classes, even personal assets such as homes, planes, cars, insurance policies, collectibles, etc.

You can even record liabilities and manage their periodic payments, ensuring a consolidated picture of your true net worth.

1. Is there a restriction to the number of login IDs per license?

2. Can I define user permissions for designated advisors, accountants, and family members?

3. Is there a record of all user activity on the system?

1. Where is my data being stored and can I take a backup?

2. Can I access the data remotely and from my mobile devices?

3. How does the system handle backups, and can they be done by individual entity?

1. Who has access to my data, and how is privacy maintained?

2. Is Asset Vantage SOC compliant, and how does it ensure data security?

3. How does Asset Vantage support compliance and audit requirements for family offices?

1. Can data from different sources be synced and uploaded to the AV platform?

2. In what format can financial data be uploaded and entered on Asset Vantage?

3. Can I review my holdings across different parameters?

4. Can I compare annualized performance of my various wealth advisors?

5. Does the platform support benchmarking?

6. Can I review performance analytics at the group or family level?

7. Can I tag holdings to asset classes as per my preference?

8. Can I create my own customised Dashboard?

9. How do I know the coupon frequency of a bond? Is this based on market data?

10. How does the system handle dividend re-investments?

11. Can I view a real estate report by property?

12. How do I keep my investment, bank and credit card transactions updated?

You can also upload bank statements to populate and categorize transactions. Once this data is categorized, the system will automatically create and update your books of accounts. We support hundreds of institutions and have activated over 5,000 global data feeds across banks, credit cards, and custody accounts.

13. Can I upload and store important documents in digital formats?

14. Can I consolidate data for international assets?

15. How do I update values of all my illiquid assets?

1. Does the system generate short-term and long-term gains reports for investments, and income and expense reports?

2. With automated accounting, how are ledgers created?

3. What kind of accounting reports does the platform create?

4. What format is the balance sheet prepared in?

5. Can we print journal entries generated on the system?

6. Can Asset Vantage help with tax reporting and gain/loss tracking?

1. How does Asset Vantage integrate with banks and custodians?

2. What happens if a data feed is temporarily unavailable?

3. Can I still use AV if my institution doesn’t support direct feeds?

1. How does my portfolio stay updated?

2. Can I review annualized returns (IRR/TWR) since inception and for a specific period?

3. Does the system compute asset allocation over time?

1. Can we sync Asset Vantage with third party accounting software?

2. Is Asset Vantage integrated with a bill payment platform?

3. Does AV support Payroll functionality?

4. Does AV support accounting for business operating entities?

5. Does AV keep audit history of transactions?

1. What is the Document Vault, and how is it useful?

2. How does Asset Vantage ensure the security of my uploaded documents?

3. Can I control who in my team has access to certain documents?

4. Where can I upload or attach documents in Asset Vantage?

- Entity/Group Level: Via Menu > Masters > Entity/Group -useful for organizational or ownership-based documents.

- Transaction Level: Via Menu > Transactions – ideal for attaching invoices, statements, or proof documents tied to specific transactions.

- Document Vault: Via Menu > Document Vault- a centralized repository that displays all documents uploaded across entities, groups, and transactions.